The latest results for the third quarter of 2019 continue to tell a convincing story of opportunity for hotels. Regardless of all the other areas of technology development in the hotel sector, some of which are short-term fads or just the latest buzzwords that won’t deliver, the switch to mobile in the consumer space can be absolutely relied upon as happening, relevant and a clear and present opportunity.

Traffic On Mobile

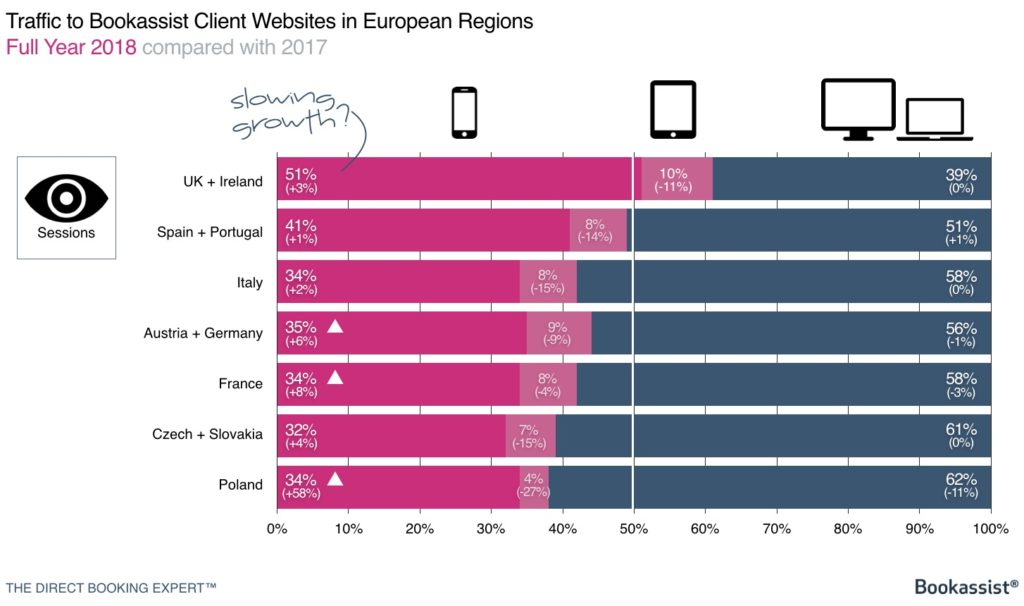

Looking first at the behaviour of mobile traffic, the full year results for 2018 seemed to indicate that mobile traffic growth to hotels was slowing somewhat across all markets that we study (Figure 1). However, we presented results earlier this year at the BTO Florence conference that showed a change developing again in 2019.

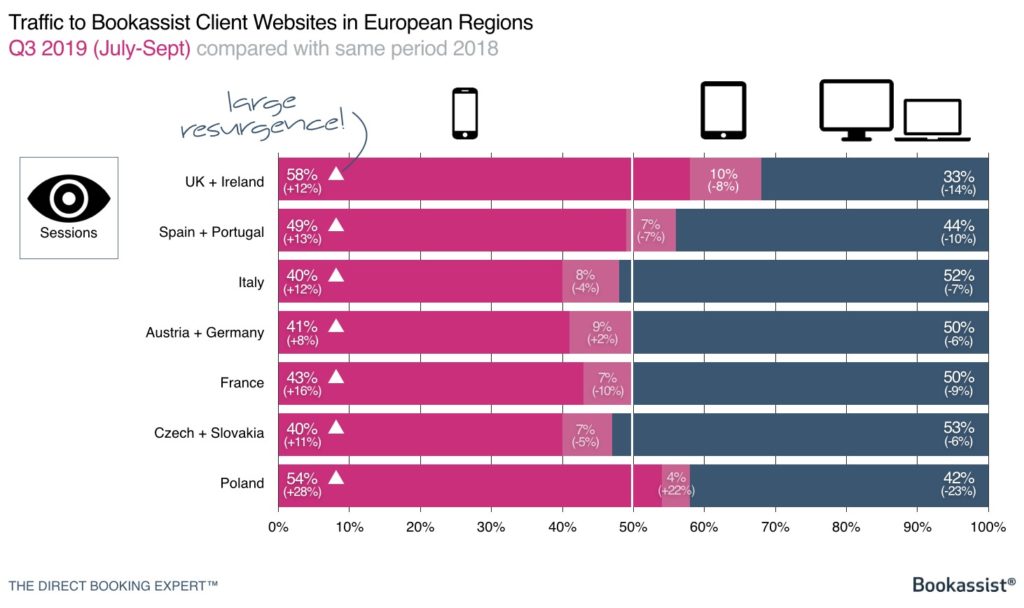

As Figure 2 shows, the results for the third quarter of 2019 indicate that hotels in almost all European markets now experience less than 50% of their traffic on desktop/laptop and the switch continues towards mobile.

The trend was essentially universal, whether for city or non-city hotels, and regardless of star rating or size.

Revenue On Mobile

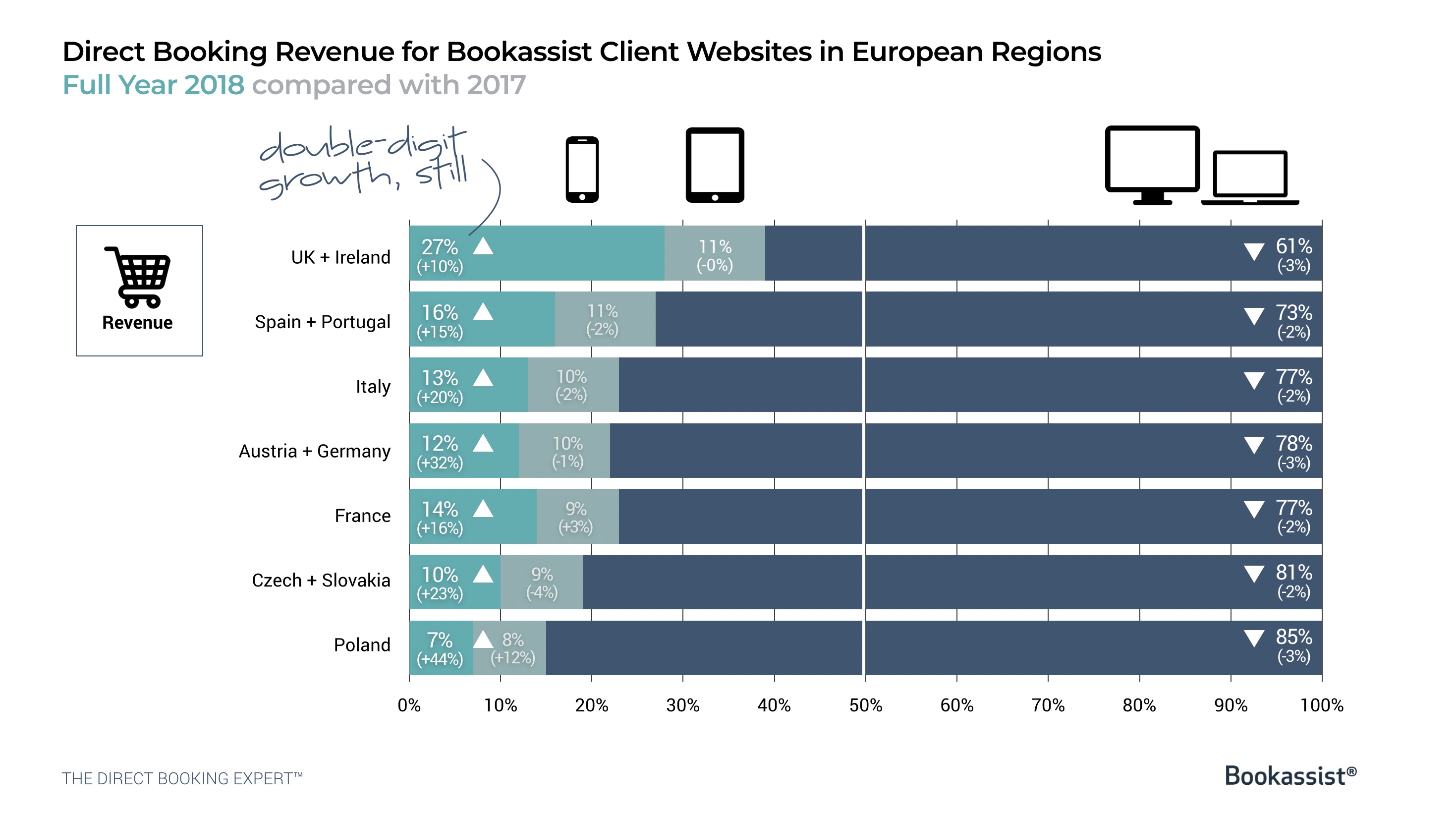

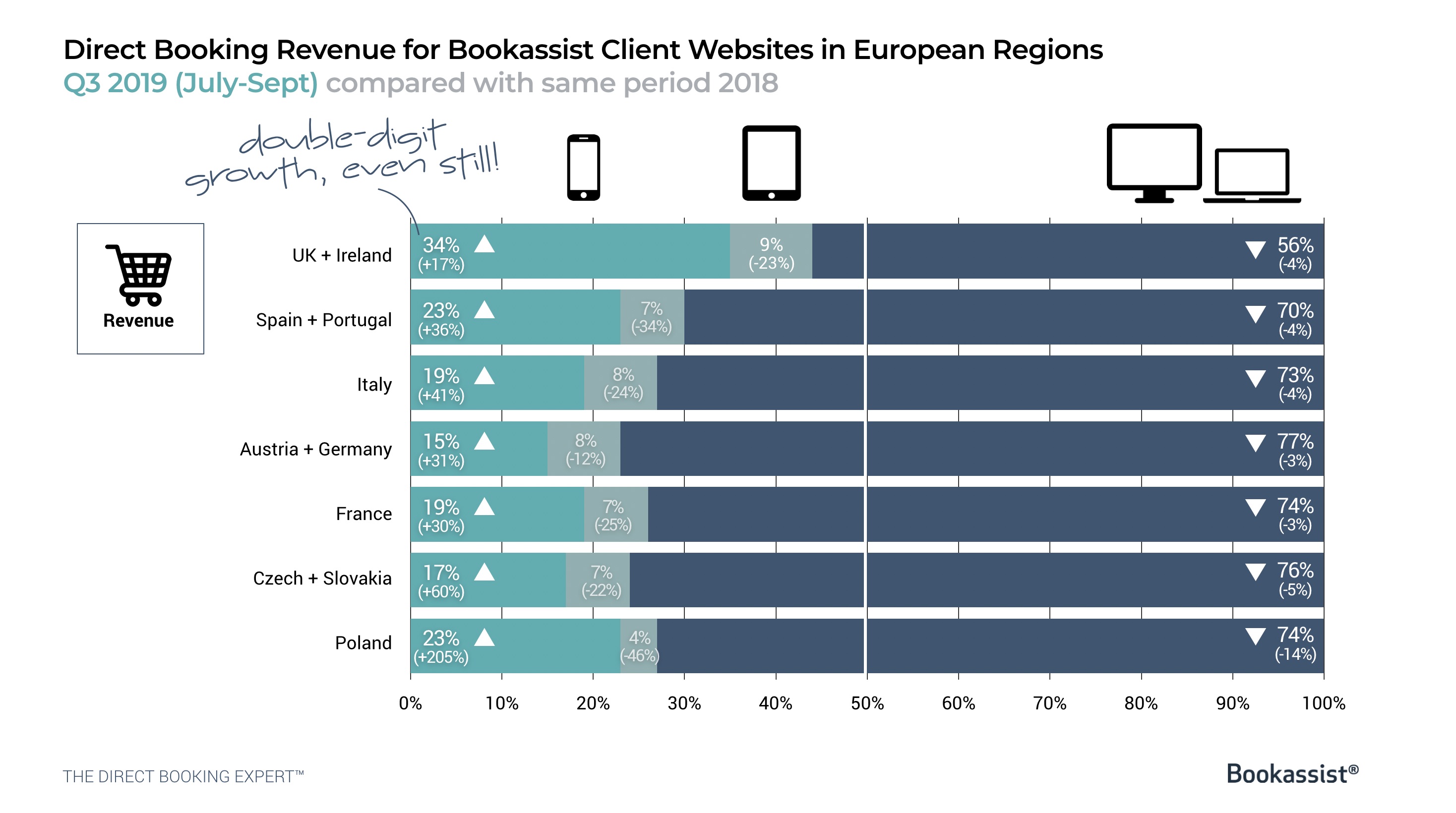

When we look at revenue generated by Bookassist hotels on mobile, we see a familiar industry pattern where the proportion of revenue on mobile compared to desktop/laptop lags behind the traffic profile. Nevertheless, comparing figures 3 and 4, we are seeing clear and substantial growth in revenue being generated and the gap with desktop being closed.

In fact, the double-digit growth rate of revenue generation on mobile was larger in Q3 of 2019 than any quarter in 2018. In Ireland and the UK in particular, we are now well in excess of 40% of revenue being generated on mobile.

Bottom Line

Mobile needs specific focus and attention if the opportunity is to be optimised. User behaviour differs, and platform capabilities and expectations differ. It is imperative that hotels deliver a true app-like mobile experience to their direct-booking customers or they risk losing opportunity and lifetime value.

Bookassist hotels have had the advantage in 2019 of operating with the V10 Mobile booking engine platform, the highly mobile-specific booking engine system released in late 2018. V10 Mobile is the most app-like experience available for hotel bookers and is continually updated to meet the moving goalposts of Google mobile speed test requirements. Clearly this platform has contributed to the higher conversion we now see on mobile for Bookassist hotels.