By Pawel Debakowski, Claire Sawier, and Des O’Mahony

The Options For Direct

Every hotelier knows the advantage of direct online bookings to their hotel. But there is more to direct than just bookings on your website booking engine. In recent years, for example, meta search has become a strong option to capture traffic via online marketplaces but fulfil the booking directly with your hotel online. At Bookassist our metasearch management team has delivered metasearch bookings growth of 130% in the first quarter of 2018 versus the last quarter of 2017 (see https://bookassist.org/company/testimonials/en/). While there is an additional commission for that traffic versus on-website bookings, it is not at punitive OTA levels, and the customer data is the hotel’s and there to be taken advantage of pre-, during and post-stay.

Is there anything else that can be done to improve hotel margins, other than playing the game of moving bookings between B2C channels, direct and various OTAs? What if you could be getting additional bookings at a cost much lower than the cost of OTA bookings without cannibalising your direct business? An often overlooked and misunderstood service that can deliver just that is the global distribution system, or GDS. When managed properly as an additional distribution channel, GDS bookings can generate increased margins that can be very attractive indeed.

The Global Distribution System

The GDS is a large computer network that represents a single point of entry to travel agents and travel sites worldwide. (It also deals with airline, car rental and bus and rail services, but we won’t consider those here.) The main players in GDS, who compete with each other, are Sabre, Amadeus and Travelport (which comprises Galileo, Apollo and Worldspan). GDS services may be provided to hotels by a “provider”, such as Bookassist, who acts as the first point of contact for GDS with the hotel. The main players may also be providers in some cases.

The GDS is particularly important when it comes to business travel and corporate travel accounts. Many large companies continue to use travel agents or even internally-based travel desks to manage their travel expenses.

A Source of Incremental Bookings

A 2017 study of more than 900 travel agents located throughout 52 countries revealed that travel agents are continuing to report a record use of the GDS for hotel reservations. The study predicted that GDS hotel booking growth would surpass 68 million reservations in 2017 – an increase of over 2 million hotel bookings generated in 2016. Their business intelligence data also demonstrated that GDS hotel bookings and average daily rates (ADR) generated through travel agents are on the rise.

The GDS in particular provides corporate business bookings and agency bookings that in most cases cannot be obtained in any other way. In other words, if a GDS agent/booker is not finding your hotel in the GDS, they will not look for it on other channels – they will instead stay within the GDS environment and will book a different hotel that is available there instead.

It’s important to note also that GDS corporate business typically delivers a quality customer that usually augments hotel F&B/C&B revenue using his employer expenses to wine and dine in the hotel, in contrast to leisure travellers who tend to spend outside the hotel.

Commissionable and Non-Commissionable GDS Bookings

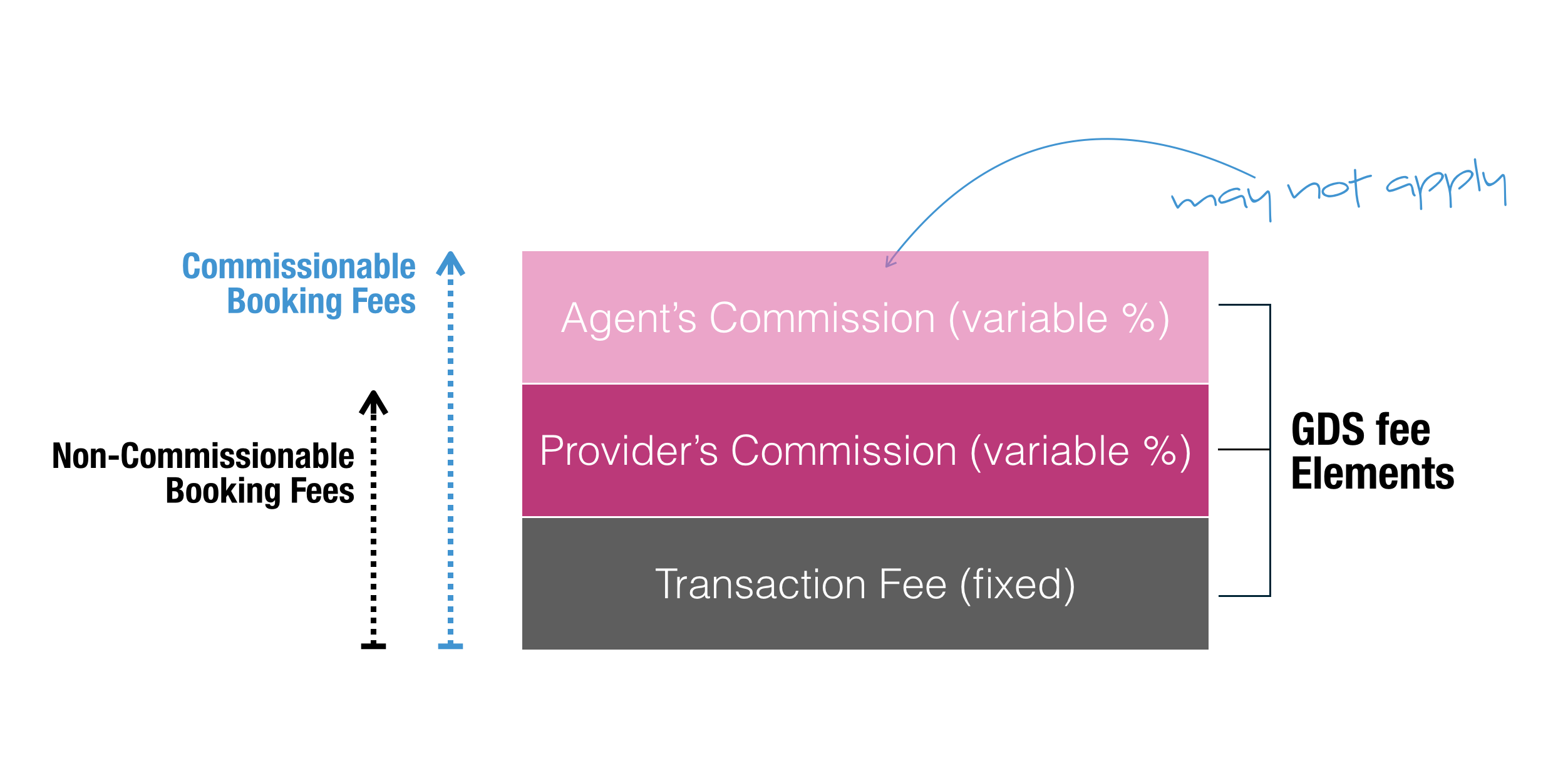

Fees for GDS bookings can often appear complex compared to the “simple” model of OTAs. With GDS, there is firstly a fee per booking for the use of the GDS systems, often called a transaction or pass-through fee, which is fixed. There may then be additional commissions due to the GDS provider company, and commissions due to the travel agent making the booking. There are two types of GDS booking that can occur, called commissionable and non-commissionable, which refer to whether the travel agent is due commission or not.

In discussions with Bookassist, one of the largest networks of TMCs (travel management companies), indicated that over 80% of bookings they now manage are non-commissionable. For the hotel, there are only two costs associated with acquiring a non-commissionable booking – the GDS transaction fee and the provider’s commission.

For commissionable bookings, you need to add typically 8-10% agency commission on the top of the GDS transaction fee and the provider’s commission. But even at that, you are getting the best available rate (BAR) for the booking, and typically that quality business customer that generates additional spend.

GDS Cost Per Acquisition

So where does the GDS stand in terms of all-important cost per acquisition (CPA)? Because of the fixed transaction fee element, calculation of the CPA of a GDS booking will depend on the hotel sale rate achieved and the length of stay. In other words, it depends on the booking value. For example a transaction fee of €9 could account for 10% or more for a single night BAR booking, while in other cases the transaction fee can be less than 1% when a booking is made for multiple nights and/or the rate achieved is high. In those cases, such bookings often cost as little as 5 or 6% with certain GDS providers.

At Bookassist, our GDS team is now achieving CPA averages across all hotels of approximately 14% on the combination of commissionable and non-commissionable GDS bookings, down from 15% in 2017. Our highly-optimised hotels are achieving 12% or less on the mix, with many non-commissionable bookings at 7% or less.

Working the GDS

There are also other opportunities within the GDS environment that can be availed of, such as the commonly talked about ‘consortia’, GDS marketing, GDS preferred listings and more. These services all cost extra and can be effective – but they do not work equally well for all properties.

For the individual hotelier, the requirements for applying to consortia or account managing their property on the GDS can be onerous. This is where a managed service such as Bookassist’s comes in, leaving the hotelier free from the day-to-day GDS management but assured that optimised GDS bookings simply flow through. Very few providers offer a truly managed service, but availing of it where possible has a clear positive impact on performance and is definitely recommended.

RFP Management – Open For Business

Similar to how one uses digital marketing to promote the use of the direct sales channel, we can use marketing techniques in the GDS to enhance return. Primary among those techniques is RFP Management. RFP is “request for proposal”, where companies make the market aware of the volume of bednights they expect to need for the upcoming year.

Hotels can already greatly benefit from positioning the commissionable, GDS BAR bookings within their online business mix, but it is the proper management of GDS RFPs and corporate sales relationships that really let you to show off your revenue management skills.

Once a year, hotels have the opportunity to bid for corporate GDS business depending on their location, amenities and the standards set by particular company requirements. RFP management tools and related market intelligence can be of great help in securing the right business. For example, corporate room-night requirements per location worldwide as well as corporate office/production plant locations are available to hotels during RFP season. When managed appropriately, the information can be used to secure valuable incremental business at good margins.

While the initial work involved in RFPs can be onerous, providers such as Bookassist can manage the task for the hotelier and deliver the business. The RFP “season” is now underway in relation to corporate room-night requirements for 2019 and represents a real opportunity for hotels near key companies and industries.

Bottom Line

GDS business can be a significant source of incremental bookings and increased margin. Hoteliers have a great opportunity to generate incremental revenue and maximise revenue per available room (RevPAR) through the power of the GDS. When optimised, cost per acquisition is significantly better than OTAs, and the guest spend per stay is likely far higher. The RFP season is now underway for 2019 and represents a real opportunity for hotels to tap into that incremental direct business.

It’s time to make sure that you are open for business on the GDS.

—

Pawel Debakowski is Head of Product for GDS, Claire Sawier is Head of Marketing, and Des O’Mahony is CEO & Founder at Bookassist (http://www.bookassist.com), the multi-award-winning technology and digital strategy partner for hotels worldwide. Bookassist is The Direct Booking Expert™ and is a Google Premium Partner.